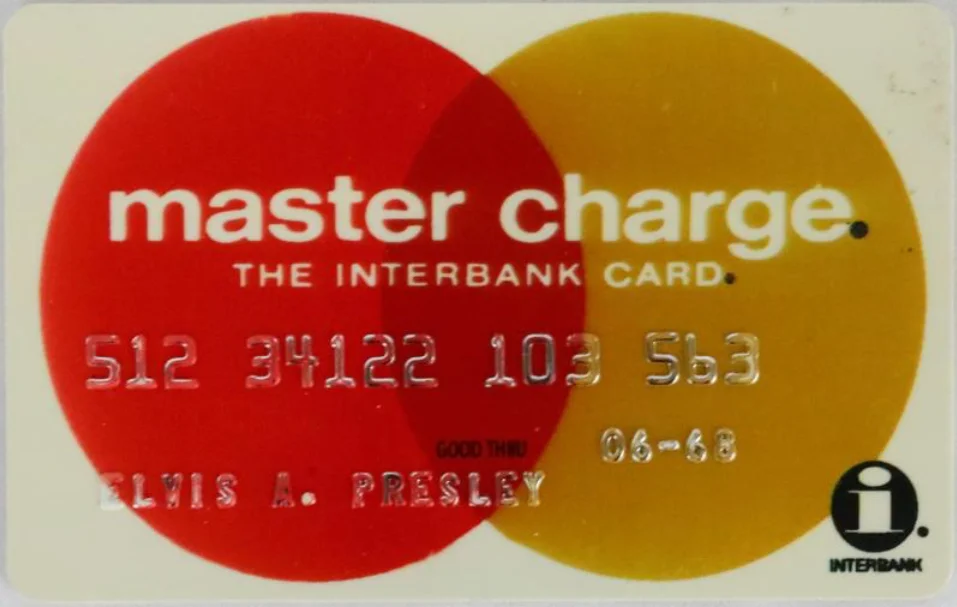

Master Charge

Before I started my Civil Service job in 1980, I worked in the banking industry. This included working in four different states and banks over about 13 years. I held several positions, primarily as a line teller but also as a bookkeeper and at the new accounts desk. This was before checking; savings accounts had magnetic accounts and bank routing numbers.

The customer’s check withdrawals were posted daily based on signature recognition along with their deposits. After all these years, there are some signatures that, if I saw on a check today, I would know whether it was the real person who had signed it.

In the late ’60s, I worked at a Peoples’ National Bank in Tullahoma, Tennessee. The birth of credit cards was unfolding, and Master Charge was taking off. Banks were offering charge cards to their customers and establishing agreements with businesses around town to accept the cards.

I was placed on a team responsible for getting the program up and running for the bank. We would visit businesses around town, discuss the program’s value, and set them up with the equipment they would need to accept the card.

Some of you are too young to remember the process, but it went like this: The clerks filled out a form, placed the form in a machine, placed the card under the form, and ran the imprinter mechanism over the form and card to “imprint” the numbers and name on the form.

This form would be signed by the customer and mailed to the bank to receive payment. I searched online to see if these old machines had a name, and what came up is they were colloquially known as a ZipZap machine or a Knuckle Buster.

And do you recall that there was also a phone authorization process? The merchant would call a phone number listed on the card, give the credit card number to the representative, and wait for authorization by verbal confirmation.

Can you imagine if we were still using this process? But we’ve come a long way with our electronic credit card processing with just the swipe of the card. The cards have “chips” now as opposed to the magnetic strips.

I got to thinking about my role in the credit card world when I looked at my credit card, and although it has a chip, my name, card number, and expiration date are in raised lettering on the face of the card.

This was my job at People’s Bank. When a new customer wanted a card or replace a lost or expired card, I would sit at a machine like an oversized typewriter, insert the plastic card in the device, and manually type all the information.

As I typed, the keys on the device came up from underneath and imprinted the raised lettering on the card. I tried to be careful but occasionally made a boo-boo and had to start over. I doubt this is how the cards are made today ?.

At the time, I thought the idea of credit cards was silly. Why would I want to use a credit card to purchase when I could write a check? I see now that I was NOT a visionary. I use a swipe card today and see how efficient the world has become, but it is still not my favorite.

When we have something in the office that requires payment, the person will say just Venmo me the payment. I am still trying to understand what they mean by that. So, I pull out my checkbook and say, “do you accept paper payment.” Old habits are very HARD to break!